New Jersey Inheritance Tax 2025

New Jersey Inheritance Tax 2025. The tax rates and exemptions. For a client without a spouse or descendants, charitable.

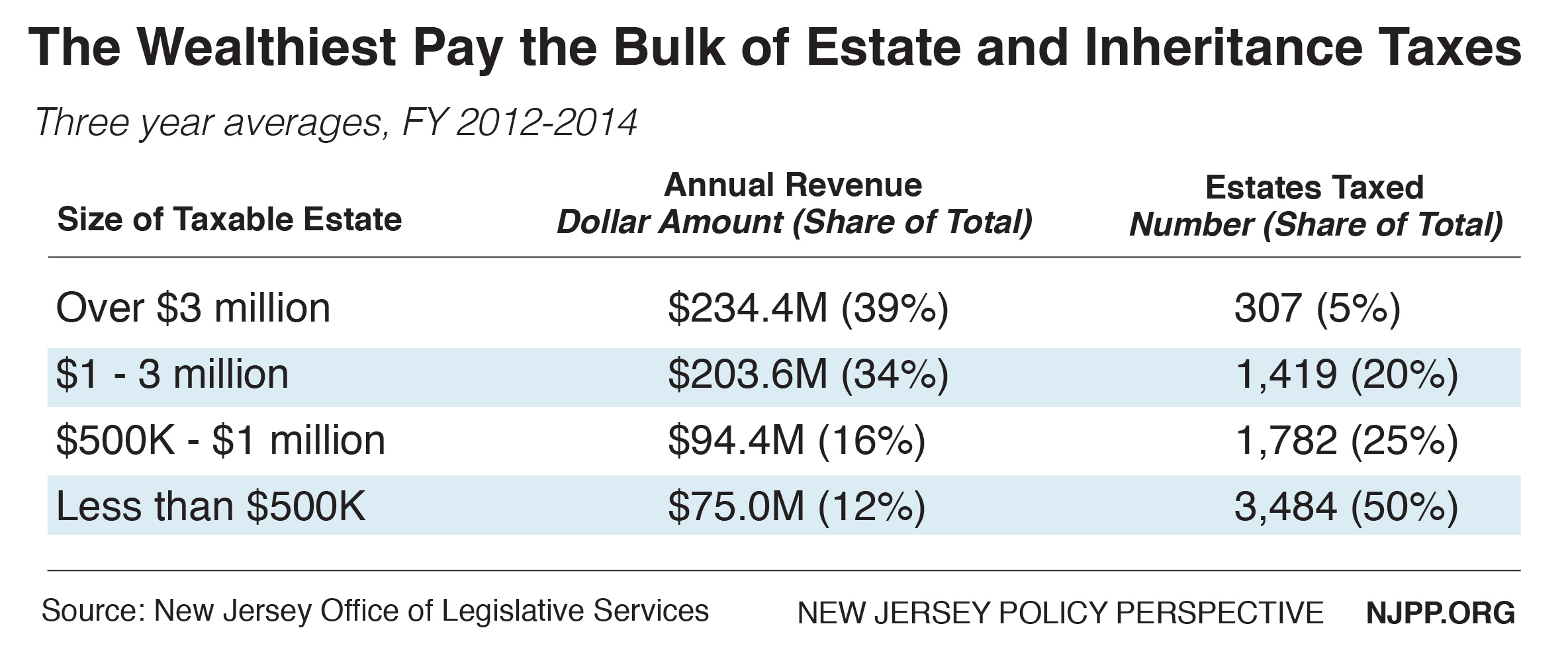

Rates depend on the amount received and the relationship between the decedent and the beneficiary or.

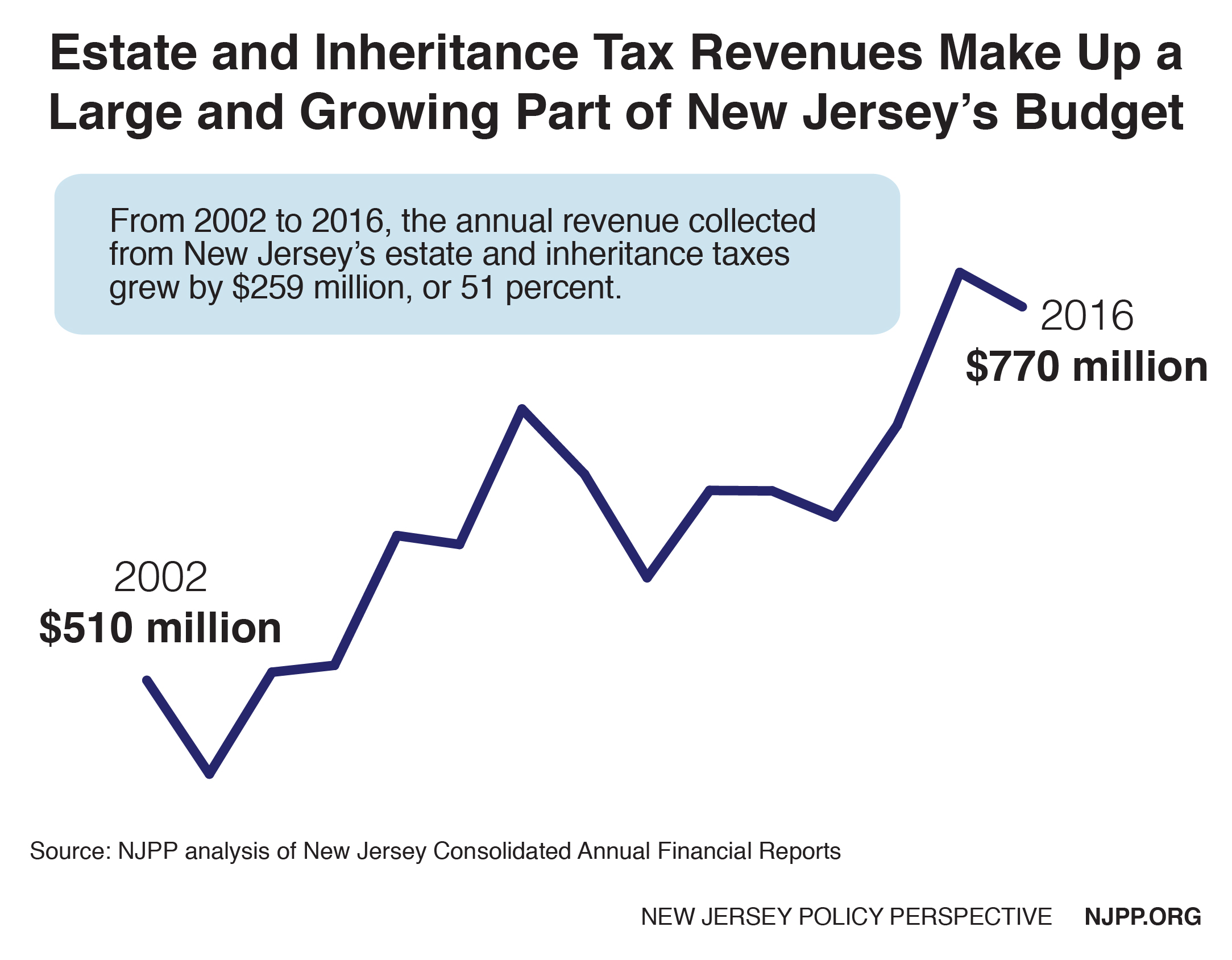

Fairly and Adequately Taxing Inherited Wealth Will Fight Inequality, It takes an average time of 15 to 18 months to sell an inherited property, depending on the probate process. New jersey has an inheritance tax.

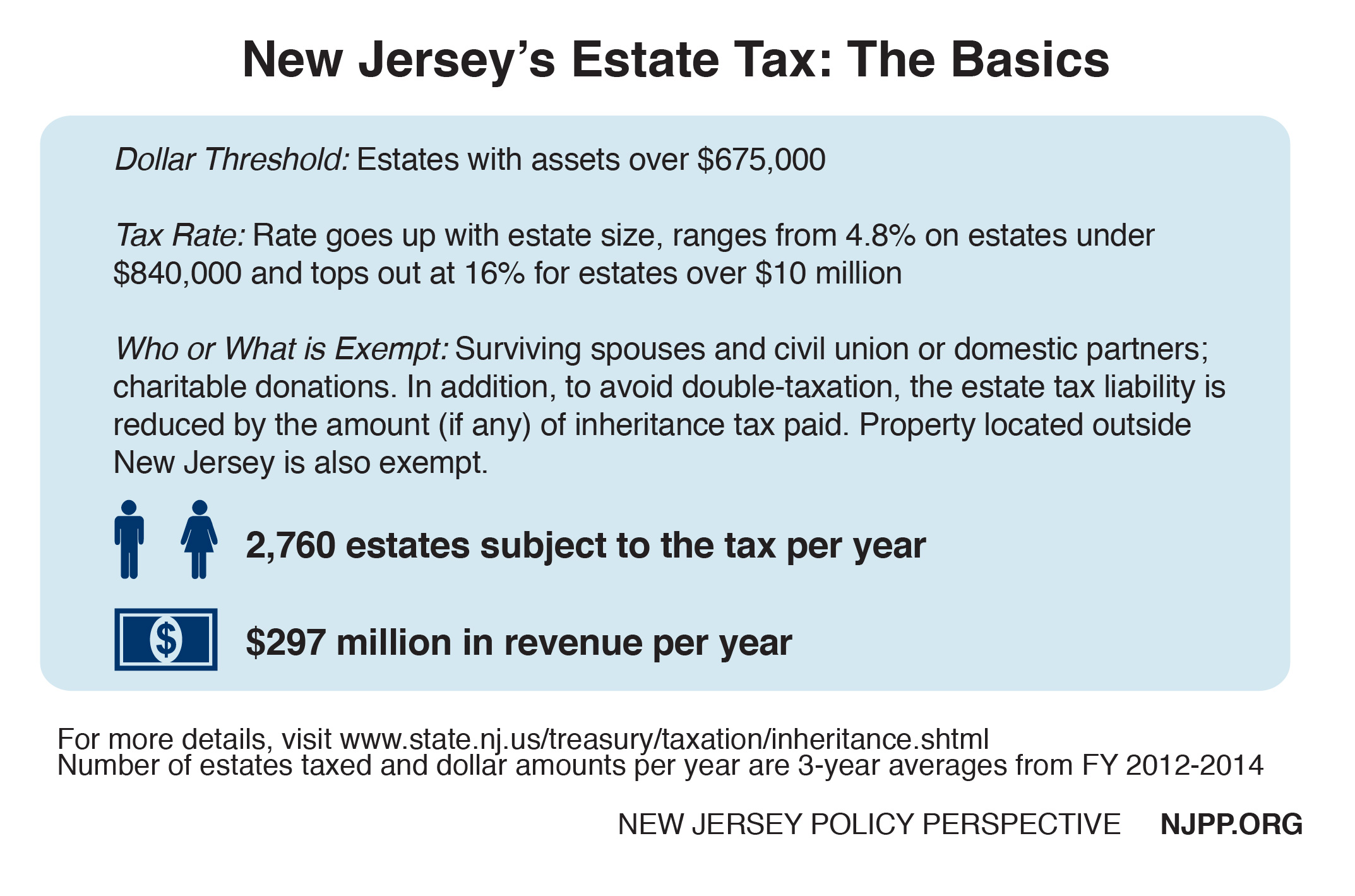

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. New jersey recently repealed its estate tax effective jan.

Eliminating New Jersey’s Estate Tax Like Robin Hood in Reverse New, The state of new jersey does not tax social security retirement benefits, military pensions, or even railroad retirement benefits. Rates depend on the amount received and the relationship between the decedent and the beneficiary or.

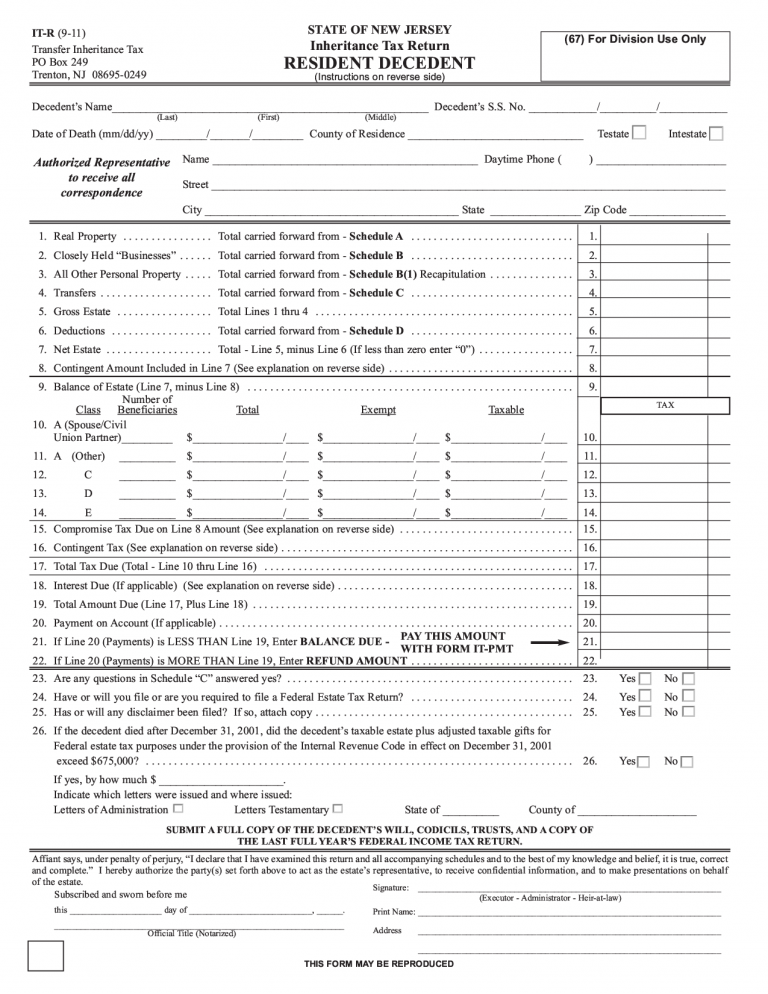

The dreaded New Jersey inheritance tax How it works, who pays and how, The inheritance tax is a tax on a beneficiary’s right to receive property from a decedent. The amount of capital gains owed is determined largely by the difference between the value at the time of purchase and the value at the time of transfer.

Fairly and Adequately Taxing Inherited Wealth Will Fight Inequality, If you make $70,000 a year living in delaware you will be taxed $11,042. Inheritance tax by state 2025.

Dealing With The Obnoxious New Jersey Inheritance Tax Waiver And When, The tax rates and exemptions. New jersey levies an inheritance tax on assets.

The inheritance tax is slowing down my inheritance. What can I do?, 1, 2018, but it remains one of a handful of states that will still. In iowa, heirs must pay 15 percent taxes to the state when receiving assets from a deceased loved one.

Estate and Inheritance Taxes Urban Institute, The inheritance tax is a tax on a beneficiary’s right to receive property from a decedent. + $ 0 inheritance tax.

New Jersey Inheritance Tax Professional ThorpeForms, New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. New jersey has an inheritance tax.

Handling Inheritance in a Divorce Process in New Jersey, The tax rate is 11% on the first $1,075,000 inherited. Rates depend on the amount received and the relationship between the decedent and the beneficiary or.

Our newark regional information center will be closed friday, march 15, 2025, and is scheduled to reopen on monday, march 18, 2025.